SEO Search Engine Optimization

SEO, or Search Engine Optimization, is a set of practices aimed at improving a website’s visibility and ranking in search engine results pages (SERPs). It involves optimizing various elements of a website, including content, meta tags, site structure, and backlinks, to make it more attractive to search engines like Google, Bing, and Yahoo.

The importance of SEO lies in its ability to drive organic (non-paid) traffic to a website. When your website appears higher in search engine results for relevant queries, it’s more likely to attract clicks and visitors. This increased visibility can lead to higher website traffic, more leads, and ultimately more conversions and sales for businesses.

Here are some key reasons why SEO is important:

Increased Visibility:

SEO helps your website rank higher in search engine results, making it more visible to potential visitors who are actively searching for information, products, or services related to your business.

Quality Traffic: By targeting relevant keywords and optimizing your content, SEO attracts high-quality traffic to your website. These visitors are more likely to be interested in what you offer, increasing the chances of conversion.

Credibility and Trust:

Websites that rank higher in search results are often perceived as more credible and trustworthy by users. Effective SEO can help establish your brand as an authority in your industry.

Better User Experience:

SEO involves optimizing your website’s structure, navigation, and content to make it more user-friendly. This not only improves search engine rankings but also enhances the overall user experience, leading to higher engagement and lower bounce rates.

Cost-Effectiveness:

Compared to traditional advertising methods, SEO is relatively cost-effective in the long run. Once your website ranks well for target keywords, you can continue to attract organic traffic without constantly paying for clicks or impressions.

Competitive Advantage: In today’s competitive online landscape, having a strong SEO strategy can give you an edge over competitors who are not investing in optimization. Ranking higher in search results can help you steal market share and attract customers away from competitors.

Overall, SEO is essential for any website looking to increase its online visibility, attract targeted traffic, and grow its business in the digital age.

We Created a Processor for the Generative AI Era,’ NVIDIA CEO Says

Generative AI promises to revolutionize every industry it touches — all that’s been needed is the technology to meet the challenge.

NVIDIA founder and CEO Jensen Huang on Monday introduced that technology — the company’s new Blackwell computing platform — as he outlined the major advances that increased computing power can deliver for everything from software to services, robotics to medical technology and more.

“Accelerated computing has reached the tipping point — general purpose computing has run out of steam,” Huang told more than 11,000 GTC attendees gathered in-person — and many tens of thousands more online — for his keynote address at Silicon Valley’s cavernous SAP Center arena.

“We need another way of doing computing — so that we can continue to scale so that we can continue to drive down the cost of computing, so that we can continue to consume more and more computing while being sustainable. Accelerated computing is a dramatic speedup over general-purpose computing, in every single industry.”

Huang spoke in front of massive images on a 40-foot tall, 8K screen the size of a tennis court to a crowd packed with CEOs and developers, AI enthusiasts and entrepreneurs, who walked together 20 minutes to the arena from the San Jose Convention Center on a dazzling spring day.

Delivering a massive upgrade to the world’s AI infrastructure, Huang introduced the NVIDIA Blackwell platform to unleash real-time generative AI on trillion-parameter large language models.

Huang presented NVIDIA NIM — a reference to NVIDIA inference microservices — a new way of packaging and delivering software that connects developers with hundreds of millions of GPUs to deploy custom AI of all kinds.

And bringing AI into the physical world, Huang introduced Omniverse Cloud APIs to deliver advanced simulation capabilities.

Huang punctuated these major announcements with powerful demos, partnerships with some of the world’s largest enterprises and more than a score of announcements detailing his vision.

GTC — which in 15 years has grown from the confines of a local hotel ballroom to the world’s most important AI conference — is returning to a physical event for the first time in five years.

This year’s has over 900 sessions — including a panel discussion on transformers moderated by Huang with the eight pioneers who first developed the technology, more than 300 exhibits and 20-plus technical workshops.

It’s an event that’s at the intersection of AI and just about everything. In a stunning opening act to the keynote, Refik Anadol, the world’s leading AI artist, showed a massive real-time AI data sculpture with wave-like swirls in greens, blues, yellows and reds, crashing, twisting and unraveling across the screen.

As he kicked off his talk, Huang explained that the rise of multi-modal AI — able to process diverse data types handled by different models — gives AI greater adaptability and power. By increasing their parameters, these models can handle more complex analyses.

But this also means a significant rise in the need for computing power. And as these collaborative, multi-modal systems become more intricate — with as many as a trillion parameters — the demand for advanced computing infrastructure intensifies.

“We need even larger models,” Huang said. “We’re going to train it with multimodality data, not just text on the internet, we’re going to train it on texts and images, graphs and charts, and just as we learned watching TV, there’s going to be a whole bunch of watching video.”

The Next Generation of Accelerated Computing

In short, Huang said “we need bigger GPUs.” The Blackwell platform is built to meet this challenge. Huang pulled a Blackwell chip out of his pocket and held it up side-by-side with a Hopper chip, which it dwarfed.

Named for David Harold Blackwell — a University of California, Berkeley mathematician specializing in game theory and statistics, and the first Black scholar inducted into the National Academy of Sciences — the new architecture succeeds the NVIDIA Hopper architecture, launched two years ago.

Blackwell delivers 2.5x its predecessor’s performance in FP8 for training, per chip, and 5x with FP4 for inference. It features a fifth-generation NVLink interconnect that’s twice as fast as Hopper and scales up to 576 GPUs.

And the NVIDIA GB200 Grace Blackwell Superchip connects two Blackwell NVIDIA B200 Tensor Core GPUs to the NVIDIA Grace CPU over a 900GB/s ultra-low-power NVLink chip-to-chip interconnect.

Huang held up a board with the system. “This computer is the first of its kind where this much computing fits into this small of a space,” Huang said. “Since this is memory coherent, they feel like it’s one big happy family working on one application together.”

For the highest AI performance, GB200-powered systems can be connected with the NVIDIA Quantum-X800 InfiniBand and Spectrum-X800 Ethernet platforms, also announced today, which deliver advanced networking at speeds up to 800Gb/s.

“The amount of energy we save, the amount of networking bandwidth we save, the amount of wasted time we save, will be tremendous,” Huang said. “The future is generative … which is why this is a brand new industry. The way we compute is fundamentally different. We created a processor for the generative AI era.”

To scale up Blackwell, NVIDIA built a new chip called NVLink Switch. Each can connect four NVLink interconnects at 1.8 terabytes per second and eliminate traffic by doing in-network reduction.

NVIDIA Switch and GB200 are key components of what Huang described as “one giant GPU,” the NVIDIA GB200 NVL72, a multi-node, liquid-cooled, rack-scale system that harnesses Blackwell to offer supercharged compute for trillion-parameter models, with 720 petaflops of AI training performance and 1.4 exaflops of AI inference performance in a single rack.

“There are only a couple, maybe three exaflop machines on the planet as we speak,” Huang said of the machine, which packs 600,000 parts and weighs 3,000 pounds. “And so this is an exaflop AI system in one single rack. Well let’s take a look at the back of it.”

Going even bigger, NVIDIA today also announced its next-generation AI supercomputer — the NVIDIA DGX SuperPOD powered by NVIDIA GB200 Grace Blackwell Superchips — for processing trillion-parameter models with constant uptime for superscale generative AI training and inference workloads.

Featuring a new, highly efficient, liquid-cooled rack-scale architecture, the new DGX SuperPOD is built with NVIDIA DG GB200 systems and provides 11.5 exaflops of AI supercomputing at FP4 precision and 240 terabytes of fast memory — scaling to more with additional racks.

“In the future, data centers are going to be thought of … as AI factories,” Huang said. “Their goal in life is to generate revenues, in this case, intelligence.”

The industry has already embraced Blackwell.

The press release announcing Blackwell includes endorsements from Alphabet and Google CEO Sundar Pichai, Amazon CEO Andy Jassy, Dell CEO Michael Dell, Google DeepMind CEO Demis Hassabis, Meta CEO Mark Zuckerberg, Microsoft CEO Satya Nadella, OpenAI CEO Sam Altman, Oracle Chairman Larry Ellison, and Tesla and xAI CEO Elon Musk.

Blackwell is being adopted by every major global cloud services provider, pioneering AI companies, system and server vendors, and regional cloud service providers and telcos all around the world.

“The whole industry is gearing up for Blackwell,” which Huang said would be the most successful launch in the company’s history.

A New Way to Create Software

Generative AI changes the way applications are written, Huang said.

Rather than writing software, he explained, companies will assemble AI models, give them missions, give examples of work products, review plans and intermediate results.

These packages — NVIDIA NIMs — are built from NVIDIA’s accelerated computing libraries and generative AI models, Huang explained.

“How do we build software in the future? It is unlikely that you’ll write it from scratch or write a whole bunch of Python code or anything like that,” Huang said. “It is very likely that you assemble a team of AIs.”

The microservices support industry-standard APIs so they are easy to connect, work across NVIDIA’s large CUDA installed base, are re-optimized for new GPUs, and are constantly scanned for security vulnerabilities and exposures.

Huang said customers can use NIM microservices off the shelf, or NVIDIA can help build proprietary AI and copilots, teaching a model specialized skills only a specific company would know to create invaluable new services.

“The enterprise IT industry is sitting on a goldmine,” Huang said. “They have all these amazing tools (and data) that have been created over the years. If they could take that goldmine and turn it into copilots, these copilots can help us do things.”

Major tech players are already putting it to work. Huang detailed how NVIDIA is already helping Cohesity, NetApp, SAP, ServiceNow and Snowflake build copilots and virtual assistants. And industries are stepping in, as well.

In telecom, Huang announced the NVIDIA 6G Research Cloud, a generative AI and Omniverse-powered platform to advance the next communications era. It’s built with NVIDIA’s Sionna neural radio framework, NVIDIA Aerial CUDA-accelerated radio access network and the NVIDIA Aerial Omniverse Digital Twin for 6G.

In semiconductor design and manufacturing, Huang announced that, in collaboration with TSMC and Synopsys, NVIDIA is bringing its breakthrough computational lithography platform, cuLitho, to production. This platform will accelerate the most compute-intensive workload in semiconductor manufacturing by 40-60x.

Huang also announced the NVIDIA Earth Climate Digital Twin. The cloud platform — available now — enables interactive, high-resolution simulation to accelerate climate and weather prediction.

The greatest impact of AI will be in healthcare, Huang said, explaining that NVIDIA is already in imaging systems, in gene sequencing instruments and working with leading surgical robotics companies.

NVIDIA is launching a new type of biology software. NVIDIA today launched more than two dozen new microservices that allow healthcare enterprises worldwide to take advantage of the latest advances in generative AI from anywhere and on any cloud. They offer advanced imaging, natural language and speech recognition, and digital biology generation, prediction and simulation.

Omniverse Brings AI to the Physical World

The next wave of AI will be AI learning about the physical world, Huang said.

“We need a simulation engine that represents the world digitally for the robot so that the robot has a gym to go learn how to be a robot,” he said. “We call that virtual world Omniverse.”

That’s why NVIDIA today announced that NVIDIA Omniverse Cloud will be available as APIs, extending the reach of the world’s leading platform for creating industrial digital twin applications and workflows across the entire ecosystem of software makers.

The five new Omniverse Cloud application programming interfaces enable developers to easily integrate core Omniverse technologies directly into existing design and automation software applications for digital twins, or their simulation workflows for testing and validating autonomous machines like robots or self-driving vehicles.

To show how this works, Huang shared a demo of a robotic warehouse — using multi-camera perception and tracking — watching over workers and orchestrating robotic forklifts, which are driving autonomously with the full robotic stack running.

Huang also announced that NVIDIA is bringing Omniverse to Apple Vision Pro, with the new Omniverse Cloud APIs letting developers stream interactive industrial digital twins into the VR headsets.

Some of the world’s largest industrial software makers are embracing Omniverse Cloud APIs, including Ansys, Cadence, Dassault Systèmes for its 3DEXCITE brand, Hexagon, Microsoft, Rockwell Automation, Siemens and Trimble.

Robotics

Everything that moves will be robotic, Huang said. The automotive industry will be a big part of that. NVIDIA computers are already in cars, trucks, delivery bots and robotaxis.

Huang announced that BYD, the world’s largest autonomous vehicle company, has selected NVIDIA’s next-generation computer for its AV, building its next-generation EV fleets on DRIVE Thor.

To help robots better see their environment, Huang also announced the Isaac Perceptor software development kit with state-of-the-art multi-camera visual odometry, 3D reconstruction and occupancy map, and depth perception.

And to help make manipulators, or robotic arms, more adaptable, NVIDIA is announcing Isaac Manipulator — a state-of-the-art robotic arm perception, path planning and kinematic control library.

Finally, Huang announced Project GR00T, a general-purpose foundation model for humanoid robots, designed to further the company’s work driving breakthroughs in robotics and embodied AI.

Supporting that effort, Huang unveiled a new computer, Jetson Thor, for humanoid robots based on the NVIDIA Thor system-on-a-chip and significant upgrades to the NVIDIA Isaac robotics platform.

In his closing minutes, Huang brought on stage a pair of diminutive NVIDIA-powered robots from Disney Research.

“The soul of NVIDIA — the intersection of computer graphics, physics, artificial intelligence,” he said. “It all came to bear at this moment.”

Why This Bitcoin Crash?

Bear markets have grown almost routine for Bitcoin and other cryptocurrency prices. Since its 2009 launch, Bitcoin’s price has tumbled more than 50% six times.

Coinbase (COIN) CEO Brian Armstrong, in a June 14 letter announcing an 18% staff cut, offered assurance despite the latest Bitcoin crash and walloping of other crypto prices. Armstrong said the cryptocurrency exchange “has survived through four major crypto winters” and is taking the steps needed to do so again.

Yet this storm is on an entirely different level. “It’s a crypto ice age,” Mizuho analyst Dan Dolev told IBD. “I think this is going to be very deep, very prolonged, and many cryptocurrencies will not survive.”

The blowup of supposed “stablecoin” TerraUSD, wiping out $40 billion in market value, has accelerated a deleveraging wave that has yet to run its course. This month, crypto lending platform Celsius Network, which oversaw $20 billion in crypto deposits and loans, halted withdrawals as it faced a liquidity crunch.

Both Terra, a blockchain payment and savings network, and Celsius offered double-digit interest payments that depended on bullish crypto scenarios. But the collapse of those Wild West business models is less a cause than a symptom of crypto’s unraveling. The real reason the cryptocurrency market is imploding: Bitcoin and the other roughly 19,000 digital currencies are up against their first Federal Reserve tightening cycle to stem an inflation outbreak.

Easy Money Fueled Cryptocurrency Prices

For most of their existence, cryptocurrencies have enjoyed the balmiest of monetary conditions. The period since Bitcoin’s launch has mostly seen the Fed trying to prop up demand. Over that time, the Fed bought up $6.5 trillion worth of Treasuries and government-backed mortgage securities. That suppressed rates in a bid to encourage risk-taking, boost asset values and stimulate demand through wealth gains.

The bulk of those Fed purchases — $4.5 trillion — came after the coronavirus lockdown cratered the economy in March 2020. Alongside multiple rounds of fiscal stimulus, ultra-easy Fed policy worked only too well. All that monetary fuel supercharged the vaccine-enabled economic reopening and touched off the biggest bout of inflation in 40 years.

Now the reversal of unprecedented Fed stimulus is deflating most asset values. The surge in the 10-year Treasury yield has hit growth stocks in particular. Their future earnings streams are less valuable when discounted to the present based on a higher risk-free rate of return. That helps explain why the tech-heavy Nasdaq has underperformed the broad market.

But when it comes to valuing Bitcoin and other cryptocurrencies, there are no future cash flows to discount.

The Federal Reserve’s ‘Most Anticipated’ Recession In History May Be Coming

Bitcoin Crash Shows It’s No Digital Gold

The Bitcoin crash has “debunked” the idea that it offers a hedge vs. inflation, like digital gold, Deutsche Bank economists Marion Laboure and Galina Pozdnyakova wrote in May. Rather than trading like gold, the ups and downs of cryptocurrency prices have correlated with the Nasdaq to a “staggering” degree, they wrote.

Yet cryptocurrency’s roller-coaster ride makes the Nasdaq’s volatility seem tame. Through June 23, the Nasdaq is down nearly 31% from its Nov. 22 intraday high. Bitcoin, which peaked on Nov. 10, has dived 70%.

Fed Rate Hike And Other Tightening Moves

Just days before Bitcoin began its retreat, the Fed said it would scale back $120 billion in monthly asset purchases. The timing doesn’t appear to be a coincidence. In fact, the history of Bitcoin’s peaks and valleys mostly coincides with shifts in Fed asset purchases.

The first Bitcoin crash began in June 2011, just as the Fed ended its second round of financial-crisis-era asset buys. The second coincided with the spring 2013 taper tantrum over a possible wind-down of yet-another round of asset purchases. The start of actual tapering at the end of 2013 coincided with the third Bitcoin crash.

The late 2017 crash coincided with Federal Reserve rate hikes that came as the Fed began to gently unwind asset purchases. Yet none of those instances saw anything like today’s tightening.

In late 2018, when monetary tightening helped trigger a financial market rout, the Fed’s key interest rate only reached 2.5%-2.75%. That was the highest in Bitcoin’s history. Yet once the S&P 500’s drop approached the 20% bear market threshold, Fed policymakers signaled a change in course. By autumn 2019, the Fed was cutting rates and buying more assets.

But last week, though the S&P 500 and Nasdaq had already crossed into bear market territory, policymakers decided to accelerate their tightening plans.

The Fed doesn’t target any specific asset class. However, the $2 trillion wipeout for cryptocurrency markets is all according to plan.

“We’ve seen financial conditions tighten and appropriately so,” Fed chief Jerome Powell said June 15.

Amid Cryptocurrency Price Meltdown, Players Look For Next Catalysts

Bitcoin Price Has Crossed This Line

In recent days, this Bitcoin price crash crossed a line that previous bear markets in cryptocurrency prices didn’t even approach.

Bitcoin tumbled as much as 75% from November’s record $68,990.90 to the June 18 low near $17,800. That briefly undercut its last major peak near $19,600 in December 2017. At its worst, in early 2015, Bitcoin’s low was nearly 40% higher than the previous peak.

Bitcoin has since bounced to slightly above $21,000. That’s right around the average $21,000 purchase price, Mizuho’s Dolev says.

Wiping out Bitcoin’s gains over the past 4.5 years is challenging the notion that long-term holders can’t lose. That will test the faith that ultimately determines the value of all cryptocurrencies.

That faith probably has limits, yet it clearly runs deep. Nearly 50% of Bitcoin traders on Coinbase say they won’t sell, no matter how low cryptocurrency prices go, Dolev wrote on May 19. “For the remaining ~50%, the tipping point is about $9,000,” a Mizuho survey found.

Despite the cryptocurrency price carnage, Silicon Valley VC firm Andreessen Horowitz announced a $4.5 billion crypto fund on May 25. Venture firms plowed $4.2 billion into early-stage crypto firms last month, a sizable sum, though down from $6.8 billion in April. In 2021, VC funding of blockchain firms totaled $33 billion.

Cryptocurrency’s Killer App?

What have all those billions bought? The main excitement, if not the primary purpose, of cryptocurrencies seems to be digital alchemy — creating money out of code.

No doubt, creating nearly $3 trillion out of code — then erasing $2 trillion — was an incredible feat.

NFTs, or non-fungible tokens, may be the closest thing to a killer app. NFT ownership is tracked on the same blockchain ledgers that record ownership of cryptocurrencies. The tokens can provide ownership to digital art, sports cards, music videos and the like.

But these digital collectibles may have even flimsier support than the cryptocurrencies.

The digital rights to the first-ever tweet famously sold for $2.9 million in March 2021. When put up for auction a year later, the top bid came in around $12,600.

The most expensive NFT sale over the past month was a digital print from the Bored Ape Yacht Club collection. Owning one of the 10,000 images has become a pseudo status symbol. Club members include Jimmy Fallon and Justin Bieber.

Yet Bored Apes’ valuations have plunged. The floor price — the lowest current auction price for part of the collection — has crashed 77% since the May 1 peak of $420,000, to about $97,250.

Bear Market News And How To Handle A Market Correction

Crypto Payment Functionality Revisited After Bitcoin Crash

What separates Bitcoin and most other cryptocurrencies from being mere collectibles is their utility for conducting transactions.

Progress on that front has been slow. In 2014, Stripe was the first major payments firm to support Bitcoin transactions. By 2018, it had cut off that support, citing slow transaction times, high fees and little customer interest.

Four years later, Stripe has rekindled its Bitcoin ties, while some crypto players are winning plaudits for transaction efficiency.

In April, Morgan Stanley touted Bitcoin’s Lightning Network as more practical for retailers than debit cards for small purchases. The secondary network allows for fast, low-cost transactions between off-network parties.

These transactions don’t require Bitcoin’s slow, costly, energy-intensive proof-of-work calculations to update the blockchain ledger. The Lightning Network works more like Visa (V) and Mastercard (MA), allowing for funds settlement after the transaction is complete.

Ethereum is gearing up to shift its entire network to the same kind of lightning-fast transactions, while cutting energy use by 99%.

In April, Lightning Labs, the team behind Bitcoin’s Lightning Network, announced $70 million in funding. Its new big project is to enable the network to handle transactions via stablecoins backed by fiat currencies such as the dollar.

Yet if paying with $1 stablecoins makes more sense than using Bitcoin, why should Bitcoin be valued at $20,000 or more?

“I’m a big believer in blockchain technology and smart contracts and decentralized finance,” Dolev said, citing the potential to reduce the cost of transmitting money globally. “But I make a big distinction between all these things and the hype around the coins.”

Market Forecast For Next Six Months Holds Big Risks — But Hope Too

Stablecoin Cryptocurrency Price Test

Stablecoins have been the biggest winners and losers of the latest crypto crash. Tether and USD Coin, now the third- and fourth-largest cryptocurrencies by market cap, have held essentially 100% of their value.

The coins’ value is backed by an equal amount of extremely safe assets like cash and U.S. government debt. Tether also holds short-term high-rated commercial debt. Amid crisis, they have had liquid cash at the ready to cover withdrawals.

When the TerraUSD stablecoin faced an old-fashioned bank run in May, the collateral for some $18 billion in coins was composed of other coins. That included more than $20 billion worth of Luna coins issued by the same company. Yet when push came to shove, Luna turned out to be worth next to nothing. TerraUSD broke its dollar peg on May 7, crashed to 15 cents within a week and is now worth a fraction of a penny.

Five Best Bitcoin Stocks To Watch, But None To Buy Right Now

Cryptocurrency Regulation

In some respects, stablecoins are like a crypto version of money market funds, a safe place to park cash for a modest return. But the returns weren’t modest and investors’ cash wasn’t safe in the case of TerraUSD.

While the going was good, TerraUSD holders enjoyed a 20% interest rate. That should have been a red flag.

But even money market funds struggled during the 2008 financial crisis, with the Primary Reserve Fund famously “breaking the buck.” The Securities and Exchange Commission followed with reforms requiring funds to hold more liquid assets and stress-test for crisis situations.

Something along those lines could be coming for stablecoins. That would kill off algorithmic funds such as TerraUSD that are backed by nonstable cryptocurrencies. Regulators might also impose limits on the interest paid by stablecoins.

While it’s unclear whether Congress will pass legislation regulating crypto, SEC Chair Gary Gensler has made the case that most coins are securities and already fall under the agency’s authority.

Bitcoin Crash And The ‘Wild West’ Crypto Market

Gensler compared crypto to the Wild West in a speech last August, calling it “rife with fraud, scams and abuse.” He began taking steps to rein in those practices well before the latest blowups.

Last September, Coinbase said the SEC threatened to sue the company, forcing it to shelve its about-to-launch Lend program. Coinbase had planned to offer 4% interest to customers who deposited stablecoins for lending out to others. The SEC said the stablecoin deposits amounted to an investment in a security because Coinbase doesn’t fall under banking regulations, with leverage restrictions and deposit insurance.

In February, BlockFi agreed to pay $100 million in fines after the SEC charged that its interest accounts for those who deposited crypto qualified as unregistered securities. Further, the SEC said BlockFi was operating as an unregistered investment company because it had more than 40% of assets in investment securities, including loans of crypto to institutional borrowers.

Reportedly, similar investigations were aimed at crypto lender Celsius and its 18% interest rate. But they didn’t come soon enough to prevent this month’s train wreck. Celsius raised $750 million in funds from investors last fall, but it still had to halt withdrawals as the crypto sell-off intensified after the crash of the TerraUSD stablecoin.

Bitcoin Is About The Worst Thing You Could Invest In

Cryptocurrency Prices Hangover

If you’re wondering whether cryptocurrencies are a good bet at recent crypto prices, keep in mind that the mania has only just begun to break. While Bitcoin peaked in November, the Luna cryptocurrency that was supposed to keep TerraUSD pegged to the dollar only peaked in April — before crashing to zero the next month.

The unwinding of excessive leverage, more regulatory scrutiny and a Federal Reserve tightening cycle meant to douse speculative fervor suggest a long crypto winter. A lot of business models that seemed viable and investments that seemed rational when crypto had never suffered a long losing streak are facing their first major reality check.

To some Bitcoin believers like MicroStrategy (MSTR) CEO Michael Saylor, who bet $4 billion of company funds on the cryptocurrency, the shakeout is overdue.

“What you have is a $400 billion cloud of opaque, unregistered securities trading without full and fair disclosure, and they are all cross-collateralized with Bitcoin,” Saylor said in an interview hosted by the Northman Trader market analysis site.

The implication is that shady practices across the crypto sphere and the cascading margin calls they’ve provoked are responsible for the latest Bitcoin crash. All those other cryptos also undermine Saylor’s notion that Bitcoin is a scarce resource. Bitcoin’s market cap now accounts for about 45% of total crypto value, down from 90% at the start of 2016.

What Will Follow The Ice Age In Cryptocurrency Prices

Saylor’s perspective may shortchange the role of Fed tightening and the extent to which the need for collateral to fuel crypto speculation helped boost Bitcoin’s price.

Yet inflation will eventually recede, and the Federal Reserve will end its tightening cycle. But the central bank is unlikely to return to a sustained super-easy monetary policy anytime soon.

A new crypto spring will eventually arrive. Just don’t expect it to be anything like the prior ones.

SOURCE: https://www.investors.com/news/bitcoin-crash-crypto-ice-age-fed-rate-hikes-are-reason/

Bitcoin price falls after SEC postpones key ETF decision

Bitcoin price falls after SEC postpones key ETF decision

Bitcoin fell sharply on Wednesday after the U.S. Securities and Exchange Commission (SEC) delayed a decision on a proposed bitcoin exchange-traded fund (ETF), which would have been the first financial product of its kind.

Trading Nation: Fade the dollar rally? from CNBC.

Cryptocurrency markets fell as a result. Bitcoin was down around 6 percent from 24 hours ago at 4:12 p.m. New York time, trading at just over $6,300, according to data from CoinDesk.

Investment firm VanEck teamed up with Solid X, a financial service company, earlier this year in a bid to launch an ETF that is backed by actual bitcoins rather than futures. An ETF is a financial product that tracks the price of an asset and is listed on an exchange. It means that investors don’t actually have to buy the underlying asset.

ETF’s are seen as a way for institutional investors to get into cryptocurrency investing in a safer way than buying bitcoin on a crypto-asset exchange.

This is VanEck’s third attempt to push a bitcoin ETF through, having been rejected by the SEC twice previously. On this occasion, the SEC said that it is pushing out its decision until September 30.

Bitcoin, which is the world’s largest cryptocurrency by market capitalization or value, has fallen dramatically from the the near-$20,000 record high it hit in December 2017. But bitcoin has recovered from June, when it fell below $6,000. And interest in the virtual currency appears to have increased. Bitcoin’s share of the entire cryptocurrency market is at its highest level this year and near where it was when the digital coin hit its highest price level in history.

There are a number of applications underway to get a bitcoin ETF listed, but so far none have been approved by the SEC. A second attempt by Cameron and Tyler Winklevoss, founders of crypto exchange Gemini, to list their ETF was recently rejected by the SEC.

WATCH: How to start your very own cryptocurrency

Over $9 billion wiped off bitcoin’s value after SEC delays ETF decision

The price of bitcoin fell sharply on Wednesday. The drop came after the Securities and Exchange Commission postponed its decision on approving a bitcoin exchange-traded fund (ETF) proposed by VanEck and SolidX. This is VanEck’s third attempt to push a bitcoin ETF through.

Source: CNBC

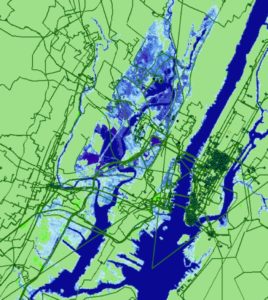

Rising sea levels will mess with the internet, sooner than you think

The internet has a vast and messy physical underpinning

Snaking beneath roads and strung across oceans, hundreds of thousands of miles of cables and their connections make up the backbone of the internet. Despite its magnitude, this network is increasingly vulnerable to sea levels inching their way higher, according to research presented at an academic conference in Montreal this week. The findings estimate that within 15 years, thousands of miles of what should be land-bound cables in the United States will be submerged underwater.

“Most of the climate change-related impacts are going to happen very soon,” says Paul Barford, a computer scientist at the University of Wisconsin and lead author of the paper.

The immediacy of the threat stems from an unfortunate coinciding of location—much of the infrastructure that supports the internet just so happens to be situated in places most prone to rising waters. Internet traffic from our devices pings through fiber optic cables bound up in tubes that lie in shallow trenches underground. Although these cables are designed to be weather-resistant, they were never meant to be waterproof, Barford says. He predicts over 4000 miles of these cables running along the coast will flood within 15 years.

What’s more, the parts of the system that are designed to be waterproof are also vulnerable. While pipes carrying streams of information along the ocean floor can withstand the stresses of the sea, these are very different than the cables buried on land. Ocean-faring tubing is endowed with “armor,” metal cabling and protective coating to keep water from its fiber-optic contents. “Of course the irony there,” Barford says, “is that those transoceanic cables have to come up above water at some point.” These landing points don’t have the same protections, and they happen to be right next to the ocean. Barford’s research shows that more than one thousand locations where cables meet—like the spots where the submarine tubes hit land—will be surrounded by water in less than two decades.

What’s more, the parts of the system that are designed to be waterproof are also vulnerable. While pipes carrying streams of information along the ocean floor can withstand the stresses of the sea, these are very different than the cables buried on land. Ocean-faring tubing is endowed with “armor,” metal cabling and protective coating to keep water from its fiber-optic contents. “Of course the irony there,” Barford says, “is that those transoceanic cables have to come up above water at some point.” These landing points don’t have the same protections, and they happen to be right next to the ocean. Barford’s research shows that more than one thousand locations where cables meet—like the spots where the submarine tubes hit land—will be surrounded by water in less than two decades.

A perpetual pool of salt water could take its toll on infrastructure. Connections may corrode and water molecules could wedge their way into microscopic cracks in fiber-optic lines. A barrage from storms and floods could damage buried cabling, all leading to signal loss. Most of this infrastructure was deployed decades ago, writes Barford, so seals and cladding protecting wires are also more likely to be vulnerable to damage.

To see where the physical backings of the internet are most vulnerable, Barford compared a map of internet infrastructure that he helped develop, with data from the National Oceanic and Atmospheric Administration’s Digital Coast project, projecting worst-case scenarios for sea level rise in the United States over the next hundred years. The overlay showed that Miami, New York, and Seattle were particularly at risk from rising waters

Source: https://www.popsci.com

Google hit with record $5b EU antitrust fine

Fined for using its Android mobile operating system to squeeze out rivals; Given 90 days to halt anti-competitive practices or face more penalties

EU Commissioner Margrethe Vestager holds a press conference on a Competition Case involving Google Android at the European Commission building, in Brussels.

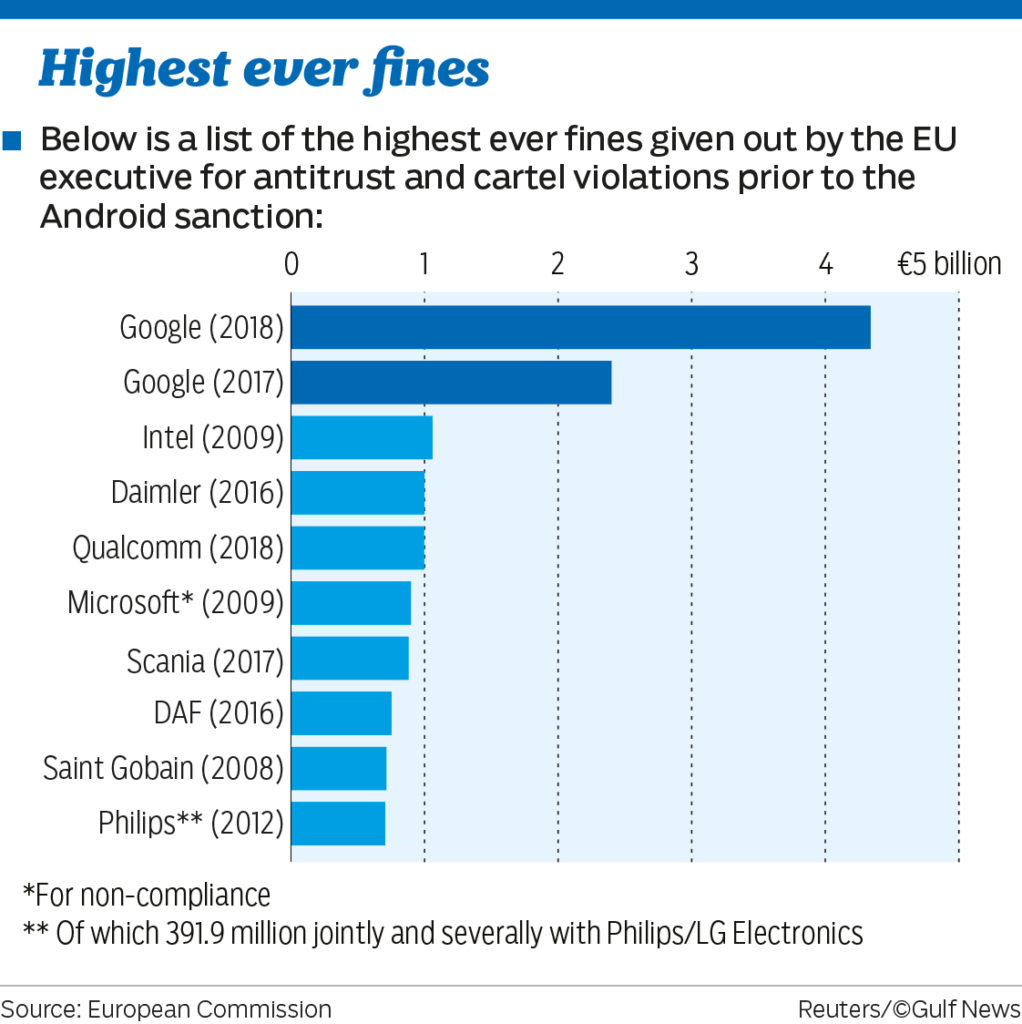

Brussels: EU regulators hit Google with a record €4.34 billion (Dh18.5 billion, $5 billion) antitrust fine on Wednesday for using its Android mobile operating system to squeeze out rivals.

The penalty is nearly double the previous record of €2.4 billion which the US tech company was ordered to pay last year over its online shopping search service.

It represents just over two weeks of revenue for Google parent Alphabet Inc. and would scarcely dent its cash reserves of $102.9 billion. But it could add to a brewing trade war between Brussels and Washington.

EU antitrust chief Margrethe Vestager denied anti-US bias, saying she very much liked the United States.

“But the fact is that this has nothing to do with how I feel. Nothing whatsoever. Just as enforcing competition law, we do it in the world, but we do not do it in political context,” she said.

Google said it would appeal the fine.

“Android has created more choice for everyone, not less. A vibrant ecosystem, rapid innovation and lower prices are classic hallmarks of robust competition,” it said.

Vestager’s boss, Commission President Jean-Claude Juncker, is due to meet US President Donald Trump at the White House next Wednesday in an effort to avert threatened new tariffs on EU cars amid Trump’s complaints over the US trade deficit.

Vestager also ordered Google to halt anti-competitive practices in contractual deals with smartphone makers and telecoms providers within 90 days or face additional penalties of up to 5 per cent of parent Alphabet’s average daily worldwide turnover.

“Google has used Android as a vehicle to cement the dominance of its search engine. These practices have denied rivals the chance to innovate and compete on the merits. They have denied European consumers the benefits of effective competition in the important mobile sphere,” Vestager said.

Switching costs to users

The EU enforcer dismissed Google’s argument of competition from Apple, saying the iPhone maker was not a sufficient constraint because of its higher prices and switching costs for users.

Android, which runs about 80 per cent of the world’s smartphones according to market research firm Strategy Analytics, is the most important case out of a trio of antitrust cases against Google.

Some major Android device makers, including Samsung Electronics Co, Sony Corp, Lenovo Group Ltd and TCL Corp, declined to comment on the EU case.

Regulatory action against tech giants like Google and Facebook with their entrenched market power may lack sting, said Polar Capital fund manager Ben Rogoff, who has been holding the stock since its initial public offering and is broadly neutral on Google.

“The reality is that as long as they’re delivering great utility to their consumers, consumers will still use those platforms. If they do, advertisers will be drawn to those platforms, too, because the ROIs (return on investment) are very difficult to replicate anywhere else,” he said.

The EU takedown of Google is six to eight years too late, with users paying the price, said Geoff Blaber of CCS Insight.

“Any action by the EU is akin to shutting the stable door after the horse has bolted,” he said.

“There is a significant danger of unintended consequences that penalises the consumer. This ranges from increased fragmentation and greater app inconsistency to increases in hardware cost should Google decide to change or adapt the Android business model.” Lobbying group FairSearch, whose 2013 complaint triggered the EU investigation, welcomed the ruling, saying it could help restore competition in mobile operating systems and apps.

“This is an important step in disciplining Google’s abusive behaviour in relation to Android,” it said.

A third EU case, which has not yet concluded, involves Google’s AdSense product. Competition authorities have said Google prevented third parties using its product from displaying search advertisements from Google’s competitors.

Vestager has also ordered a series of measures against other US companies over tax practices in some EU states, notably demanding two years ago that the Irish government take back up to 13 billion euros from Apple Inc.

Source: https://gulfnews.com/

Twitter suspends 1m ‘fake accounts’ a day

Twitter has faced sharp criticism for allegedly not doing enough to control the proliferation of bots and trolls created to spread disinformation.

San Francisco: Twitter has been suspending more than one million fake and dubious accounts per day, according to The Washington Post, in an aggressive bid to stem the flow of false information.

The social media platform has more than doubled its crackdown rate since late last year, the paper said, when testimony from Twitter, Facebook and Google revealed startling new data showing many more millions of Americans were exposed to fake news than previously thought.

Russia-linked fake accounts are believed to have fired off false tweets in an effort to sway the 2016 US presidential vote.

In recent years Twitter, which has some 336 million active users, has faced sharp criticism for allegedly not doing enough to control the proliferation of bots and trolls created to spread disinformation.

The new offensive against such accounts represents something of an ideological shift in the tech company; it had long abstained from policing potential abuses of the platform in the name of free speech.

Del Harvey, Twitter’s vice president for trust and safety, told the Washington Post that the company is changing “how we think about balancing free expression versus the potential for free expression to chill someone else’s speech.”

“Free expression doesn’t really mean much if people don’t feel safe,” Harvey told the paper.

Well-known Twitter fan Donald Trump meanwhile questioned whether the San Francisco-based company – which has not said whether the ongoing effort was behind a rare decline in its user base in the second quarter – would also target major legitimate news sources in its drive to root out false information.

“Twitter is getting rid of fake accounts at a record pace,” the US president tweeted. “Will that include the Failing New York Times and propaganda machine for Amazon, the Washington Post, who constantly quote anonymous sources that, in my opinion, don’t exist – They will both be out of business in 7 years!”

New Source: http://gulfnews.com

Digital media giants pull a fast one on privacy laws

Facebook and Google force elaborate procedures on users to stop data collection.

It’s becoming standard practice for US tech giants to follow the letter of European rulings and regulations without really changing their behaviour. Most recently, Facebook and Google have exhibited just a superficial compliance with the EU’s General Data Protection Regulation, which requires companies to allow users to keep control of their data.

The government-funded Norwegian Consumer Council issued a report showing that the tech companies’ rely on “dark patterns” to discourage users from exercising their privacy rights. The designation refers to interfaces intended to trick users into doing something, usually subscribing to a service they don’t want or giving up data.

Facebook and Google have used this strategy for some time, even as they superficially adhered to the European rules known as GDPR. The report by Norway’s agency for consumer protection details the tricks the companies use to create the illusion of compliance.

The researchers found that Facebook and Google have default settings designed to extract a maximum of personal data from users. Their GDPR-related notifications are adorned with a big, convenient button for consumers to accept the company’s current practices.

If the user declines, he or she is invited to change the settings. In effect, the system makes opting in the default response, while opting out is a multi-step process that dissuades users.

“From an ethical point of view, we think that service providers should let users choose how personal data is used to serve tailored ads or experiences,” the report says. “Defaulting to the least privacy friendly option is therefore unethical in our opinion, regardless of what the service provider considers legitimate interest.”

The consumer watchdog says Microsoft has done a better job of making it possible for consumers to protect their data. Windows offers a series of screens that invite users to make an in or out choice. Its Windows 10 update had about the same number of steps for opting in as for opting out. The Norwegian researchers hold up that design as an example of transparency.

Facebook and Google don’t just default to the most privacy-intrusive settings. They also make changing them unattractive and cumbersome.

The dissuasion begins with the colour of the buttons: Facebook’s “Accept and continue” option is a reassuring blue. “Manage data settings” is grey and appears less desirable.

Besides, the wording signals that a string of hard-to-understand and time-consuming choices lie ahead for those who select “Manage data settings”. The subliminal warning is apt: It takes 13 clicks to opt out of authorising data collection; opting in can be done with a single click.

Google’s approach is similar. And in both cases, it is even more difficult to delete data that has already been collected, for example about location history, which requires clicking through 30 to 40 pages.

“By giving users an overwhelming amount of granular choices to micromanage, Google has designed a privacy dashboard that, according to our analysis, actually discourages users from changing or taking control of the settings or delete bulks of data,” the researchers wrote.

The report also criticised the language Facebook and Google use to push consumers to accept data collection. Here’s Facebook’s pitch for its intrusive face-recognition feature: “If you keep face recognition turned off, we won’t be able to use this technology if a stranger uses your photo to impersonate you.”

But the notice doesn’t mention the limitations that “are in place on how Facebook may use this information,” the researchers wrote. “For example, the use of face recognition could be used for targeted advertising based on emotional states, or to identify users in situations where they would prefer to remain anonymous.”

Google, too, doesn’t warn about the negative side of ad personalisation (such as the potential for being selected for unbalanced political messaging): it just told users they would still see ads but “less useful” ones.

When it came to wording, Microsoft, too, was found lacking. Its interface describes the less privacy-friendly options in glowing terms, such as “Improve inking and typing recognition”, and framed them as positive decisions. The more restrictive choices were presented as negative.

The tech giants don’t limit themselves to wording and design nudges; they reward behaviour that suits their goals and threaten punishment for users who want to take a different path. Take Facebook’s “see your options” button, which appears for those who don’t want to hit “I accept”.

It brings up a screen with two options: going back to accept the terms or deleting the account. Google tells users who opt out of ad personalisation that they won’t be able to “block or mute some ads”.

Microsoft, however, tells users that Windows devices would operate normally and be equally secure regardless of their privacy choices.

The efforts to obfuscate are best illustrated by the report’s flowcharts tracking the user’s path from the GDPR popup.

Interface design and wording tricks may seem like innocent manipulations that don’t detract from the tech companies’ overall compliance with European privacy rules. But the GDPR requires “privacy by design”. What users get instead is intrusion and data harvesting by design and a limited amount of privacy if one is willing to allocate time and overcome confusion.

Privacy advocates such as the Austrian lawyer Max Schrems have filed complaints with national regulators about GDPR compliance. There undoubtedly will be more objections, which will eventually lead to lawsuits.

But that approach creates the illusion of recourse while forcing people to spend time and money fighting for rights that are granted them by EU law.

A more honourable solution was available, as Microsoft’s example shows. Of course, the software maker’s business model, unlike Facebook’s and Google’s, isn’t based on data collection.

That, however, doesn’t mean the others should have a license to pretend that they follow the rules without actually doing so. European regulators should come down hard on their practices.

News Source: http://gulfnews.com

Third Party Gmail Apps Can Read Your Emails, “Allow” Carefully!

Reminder—If you’ve forgotten about any Google app after using it once a few years ago, be careful, it may still have access to your private emails.

When it comes to privacy on social media, we usually point fingers at Facebook for enabling third-party app developers to access users personal information—even with users’ consent.

But Facebook is not alone.

Google also has a ton of information about you and this massive pool of data can be accessed by third-party apps you connect to, using its single sign-on service.

Though Google has much stricter privacy policies about what developers can do with your data, the company still enables them to ask for complete access of your Google account, including the content of your emails and contacts.

The entire Facebook’s Cambridge Analytica privacy saga highlights how crucial it is to keep track of the apps you have connected to your social media accounts and permitted to access your data.

Last year, Google itself promised to stop scanning the inboxes of Gmail users for data-driven advertisements, but the company reportedly is still giving outside app developers the ability to snoop through hundreds of millions of private Gmail messages that flow through the email service on a regular basis.

A new report by the WSJ yesterday highlighted how Gmail’s ambiguous app permissions have left your personal emails vulnerable to hundreds of third-party developers who can read nearly every detail from your most sensitive emails, including the recipient’s e-mail id, timestamps, the entire email body.

This is because Google allows third-party app developers to build services that work with its Gmail platform, like “email-based services,” “shopping price comparisons,” and “automated travel-itinerary planners,” and millions of users who have signed up for any of such services are at risk of having their private messages read by outside app developers and their employees.

Obviously, such apps get consent from users to access their inboxes as part of the opt-in process, but the news that third-party app developers could read your emails, which usually contains sensitive data, may come as a surprise to users who did not understand what they signed up for.

A Google spokesperson told the publication that the company examines all outside app developers before giving access to its service and if it “ever run into areas where disclosures and practices are unclear, Google takes quick action with the developer.”

However, unlike Facebook’s Cambridge Analytica case, there’s no evidence of any third-party Gmail add-on developer has misused your data, just being their ability to view and read private emails, which itself seems like a privacy nightmare.

How to Check and Remove Third-Party Apps Access with Your Gmail Inbox

It is time to review all the third-party apps which have access to your Gmail inbox and revoke access if you find any of them untrustworthy or unnecessary, as your email data is much more sensitive than your data on any other social media platform.

This is the only precaution you can take right now. Here’s how to do it:

Head on to your Google’s “My Account” page and log in with your Gmail credentials if you have not already.

Once logged in, you will be able to see and review all the third-party apps you have given access to your Google accounts, including Gmail.

Apps with access to your Gmail inbox will have a label called “Has access to Gmail” beneath its entry.

Since Google currently does not provide a way to get rid of just the Gmail access, you can completely disable that app’s access by hitting the “Remove Access” button.

You can also share your feedback with the tech giant if you find any site or app getting unnecessary permission to your Google account.

News Source: https://thehackernews.com